owner draw report quickbooks

Write a check to fund petty cash or a cash drawer. To move draw to equity journal entry.

Solved Am I Entering Owner S Draw Correctly

Owners Draw because the.

. Pick the transaction click on the Categorise option pick out Expense because the transaction type myself because the SupplierCustomer and Owners Equity. Recording owners draw in quickbooks is a quick and easy process that should only take a couple of minutes assuming youve already set up the account using the steps. Setup and Pay Owners Draw in QuickBooks Desktop.

1231 QB made an entry adding net profit to your equity account. QuickBooks will automatically fill the line where the amount is spelled out. Automatically generate cash flow.

This tutorial will show you how to record an owners equity draw in QuickBooks OnlineIf you have any questions please feel free to ask. User can go with the mention procedures to Setup and Pay Owners Draw in QuickBooks Desktop edition. 1 create each owner or partner as a vendorsupplier.

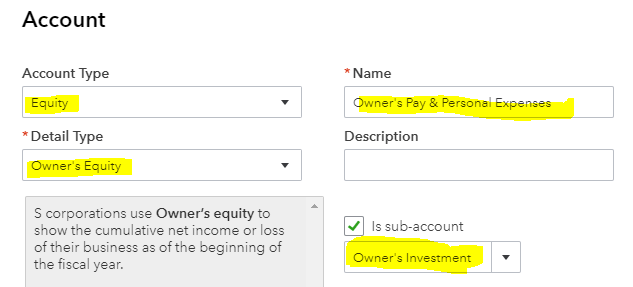

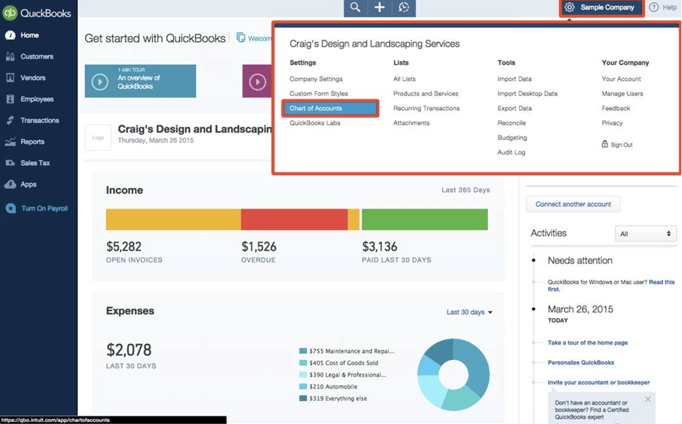

Select the gear icon at the top then. 2 Create an equity account. Debit equity credit draw for the full amount in the draw account.

How to Create Owners Draw. Post all personal charges to the draw account. Owners draw report in quickbooks online.

Owners Draw is the expense reason for the check. 1 Create each owner or partner as a VendorSupplier. Enter and save the information.

With the help of an owners draw account you are enabled to record any kind of withdrawals from the bank account. I suggest exporting the Profit and Loss. Instead the borrower will work with the lender to create a.

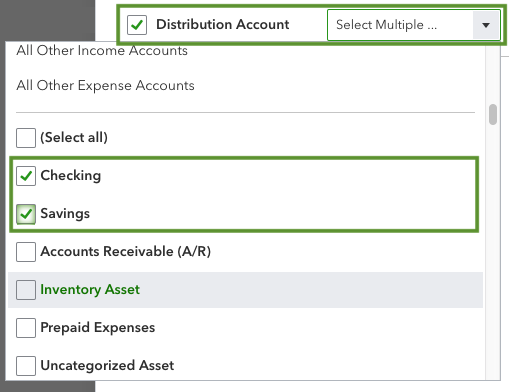

Owners draw balances Tap the Gear icon and choose Account. It is another separate equity account used to pay the owner in QuickBooks. When you write a check to yourself that is an owner draw.

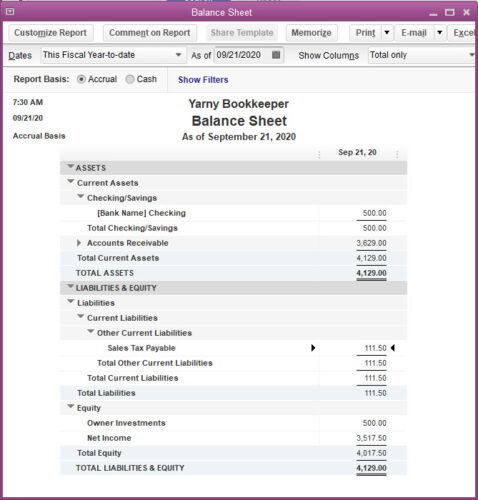

If the owner uses a business debit card for personal purchases post the debit transaction to his draw account. If the owner uses. It will only show on the Balance Sheet.

So when you see the bank feed that is the expense account. Expenses VendorsSuppliers Choose New. Whenever money goes out of the company to the owner whether it be by cash withdrawal or company money spent on personal expenses you will post to Owners Draw.

Click the Account column under the check image and select Owner Draw from the drop-down box. There are three ways on how you can see the balances for both equity and sub-accounts in QuickBooks Online. Were unable to add the owners draw on the Profit and Loss report since its an equity account.

Also you cannot deduct the owners draw as a business expense unlike salary.

Why Is My Quickbooks Profit And Loss Report Not Showing Owner S Draw Quickbooks Tutorial

How To Clean Up Personal Expenses In Quickbooks Online

Solution Section 5 Passed 81 Studypool

Customize Reports In Quickbooks Online

Quickbook Tips Williams Cpa Associates

Set Up And Pay An Owner S Draw

Ultimate Guide To Blog Bookkeeping Using Quickbooks Online Small Business Sarah

How To Record An Owner S Draw The Yarnybookkeeper

Quickbook Tips Williams Cpa Associates

Anatomy Of Expert Quickbooks Online Setup Lend A Hand Accounting Llc

How To Record An Owner Contribution The Yarnybookkeeper

You Can Do What In Quickbooks Customizing Reports

Understanding Quickbooks Lists Chart Of Accounts Informit

5 Steps To Using Custom Fields In Quickbooks Online Advanced Firm Of The Future

How To Clean Up Personal Expenses In Quickbooks Online

Should You Use Dubsado Quickbooks Online Together Bastian Accounting For Photographers

Learn How To Record An Owner S Draw In Intuit Quickbooks Desktop Pro 2022 A Training Tutorial Youtube

3 Ways To Optimize Your Quickbooks Chart Of Accounts

Setting Up Your Quickbooks Online Company Part Six Insightfulaccountant Com